Current Status Of BESS Applications In The Vietnamese Electricity Grid

The Battery Energy Storage System (BESS) plays a crucial role in integrating renewable energy and electricity supply, contributing to supporting the power sector’s goals towards global climate targets. The trend of BESS development has been accelerating in recent years.

Overview of Global Battery Energy Storage System (BESS) Development

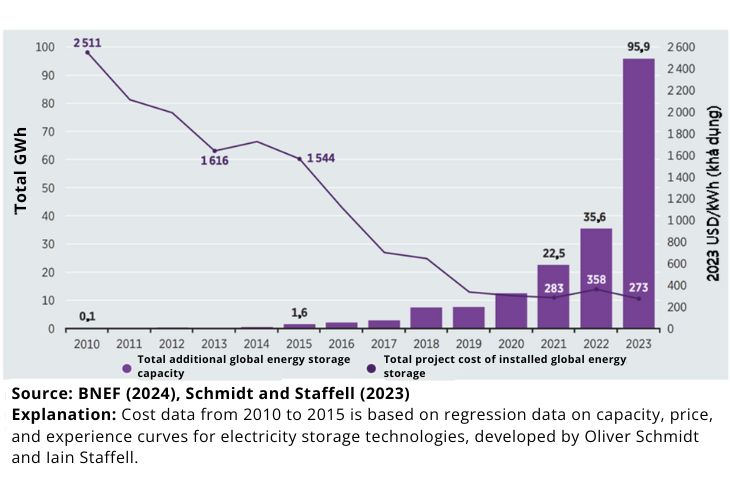

The BESS has an essential role in integrating renewable energy and supplying electricity, which helps the power sector achieve global climate goals. The trend of BESS development has been accelerating in recent years. According to a report by the International Renewable Energy Agency (IRENA), the annual installed capacity of BESS systems has increased from 0.1 GWh in 2010 to 95.9 GWh in 2023 (Figure 7.1). Specifically, in 2023, the capacity added was nearly three times higher than in 2022, with nearly half coming from China and about a quarter from the United States. The cost for energy storage projects has also decreased by 89%, from $2,700 USD/kWh in 2010 to $273 USD/kWh in 2023.

Figure 7.1. Project costs and global BESS installed capacity from 2010 – 2023

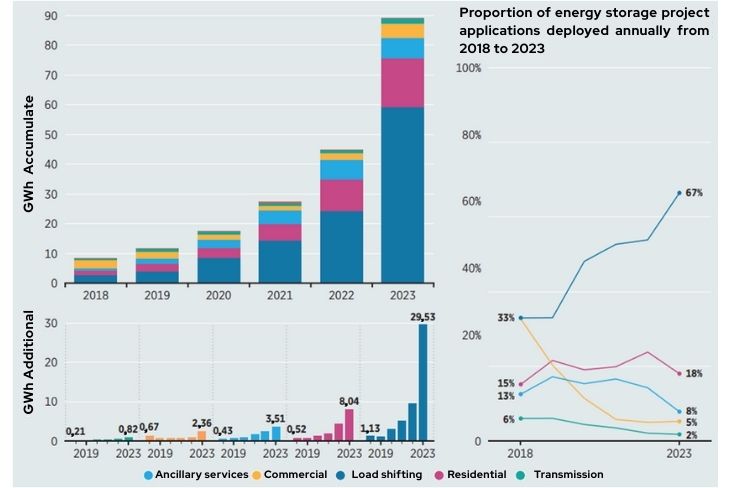

Since 2019, load shifting, which balances energy in the electricity system, has become the most common application for BESS (Figure 7.2). Specifically, BESS stores electricity from renewable sources during low-demand or low-price periods and discharges it during high-demand phases, helping stabilize the grid and improve energy efficiency. This trend has been rising, with the use of energy storage for system balancing more than doubling from 2019 to 2023, accounting for 67% of total new installed storage capacity. This increase is mainly due to the drop in battery costs, which has opened up many economic opportunities for the energy transition, especially with the growing use of solar energy.

Figure 7.2. Application trends for BESS systems

Current Status of BESS Systems Installed in Vietnam

In line with the trend of integrating renewable energy, Vietnam began implementing BESS systems from 2019. However, due to the lack of a complete set of policies and regulations for BESS development, most BESS systems in Vietnam are after-the-meter systems (electric meters) and are generally small (<100 kW), installed in homes with rooftop solar panels. Additionally, a few medium-scale systems (several hundred kW) have been installed after the meter or in small off-grid networks, such as those at PECC2, Bach Long Vi Island, Ho Chi Minh City Power’s data centers, and the Vinfast BESS installed in 2024 (Table 7.1).

Table 7.1. Some medium-sized BESS systems installed in Vietnam

| Location, Operational Time | Battery Type, Power, Capacity | Category | Integrated Renewable Energy Source and Power | Main Application |

| PECC2 Innovation Hub, 2021 | Li-ion, 750 kW, 2,557 kWh | After-meter | Rooftop solar: 420 kWp | Energy consumption optimization |

| Bach Long Vi Island, 2021 | Li-ion, 630 kW, 2,000 kWh | Off-grid | Solar: 504 kWp; Wind turbine: 1 MW | Ensure continuous power supply for isolated grid |

| EVNHCMC, 2023 | Li-ion, 312 kW, 432 kWh | After-meter | Rooftop solar: 137 kWp | Ensure continuous power supply for critical loads |

| Vinpearl Nha Trang, 2024 | LFP, 1,850 kW, 3,700 kWh | After-meter | None | Energy trading |

The BESS system at the PECC2 Innovation Hub was the largest BESS system in Vietnam at the time it began operation in 2021, reflecting PECC2’s pioneering vision and role in mastering energy storage technology applications. This system helps PECC2 reduce electricity consumption during peak hours and maintain power supply in case of grid outages. Additionally, this system helps optimize electricity from rooftop solar panels at PECC2.

At Bach Long Vi Island, BESS is part of a diverse power supply system that includes solar, wind, energy storage, and diesel generators. Due to the island’s distance from the mainland, its power grid is not connected to the national grid and operates as an isolated microgrid. Energy storage plays a key role in balancing power supply and demand, enhancing power reliability, and increasing renewable energy integration on the island.

The EVNHCMC BESS system, installed in 2023, serves the organization’s data center. This system is an integral part of EVNHCMC’s small-scale grid pilot project. The BESS ensures uninterrupted power supply for critical loads in the data center during power outages and works alongside rooftop solar to reduce peak-hour energy consumption.

The BESS system at Vinpearl Nha Trang, installed in 2024, is currently the largest BESS system, operating after the meter and not integrated with renewable energy sources. By purchasing electricity during off-peak hours and selling electricity during peak hours, the system facilitates load shifting to reduce electricity costs while also maintaining power during grid outages. This system is invested and operated by Marubeni, using LFP batteries from Vinfast’s battery factory (Source: Marubeni, project investor).

Although the potential for BESS applications is high, particularly with the rapid development of renewable energy in Vietnam, the country currently lacks any large-scale grid-connected BESS projects.

—-

Looking for expanding your company unique energy storage equipment in Vietnam? Contact SIA now!

Source: PECC2| Link