Employment Contracts and Regulations: Understanding Forms and Standards

Employment contract

In Vietnam, employment relationships are governed by contracts signed between employers and employees. These contracts can take the following forms:

1. Open-ended labor contract.

2. Fixed-term labor contract – with a duration defined by both parties, ranging from one to three years.

3. Temporary labor contract for specific projects or seasonal work – with a duration of less than one year.

Fixed-term labor contracts can only be renewed twice. After that, the employer must enter into an open-ended labor contract with the employee. If the employer does not wish to renew the labor contract with the employee, they must notify the employee of the contract termination at least 15 days before the contract’s expiration.

Contracts must adhere to the prescribed format by the Ministry of Labor, War Invalids, and Social Affairs (MOLISA). Labor contracts must include at least the following essential information: employer’s name and address, employee’s full name, date of birth, gender, address, and ID number, job position and location, contract duration, salary and payment method, salary payment deadline, promotion and wage increase system, working hours, social insurance, medical insurance, and training. Labor laws allow employers to require employees engaged in work related to trade secrets or technical secrets to sign separate confidentiality agreements, which may include penalty clauses for breaches.

Labor laws prohibit employers from retaining the original identification documents, diplomas, and certificates of employees and require employees to provide cash or property as a deposit for the performance of the labor contract at the time of signing and fulfilling the contract.

Contracts must be signed by the employer’s legal representative or an authorized person before the commencement of employment.

Minimum Regional Wages

- Zone 1 (including major cities such as Hanoi, Haiphong, and Ho Chi Minh City) – 4,180,000 Vietnamese Dong.

- Zone 2 (including rural areas of Hanoi, Ho Chi Minh City, Haiphong, as well as provincial capitals of Haisan, Hung Yen, Bac Ninh, Thai Nguyen, Nha Trang, Can Tho, and Lach Giang) – 3,710,000 Vietnamese Dong.

- Zone 3 (covering other cities and regions in Haisan, Vinh Phuc, Phu Tho, Bac Ninh, Ninh Binh, Nam Dinh, Phu Yen, Khanh Hoa, and Binh Dinh provinces) – 3,250,000 Vietnamese Dong.

- Zone 4 (the least developed areas in Vietnam) – 2,920,000 Vietnamese Dong.

The above are the minimum wage standards for different regions and serve as the basis for salary and wage payment arrangements between businesses and employees. These wage standards apply to employees who work under normal working conditions, meet monthly working hour standards, and fully fulfill the prescribed labor productivity standards or agreed-upon job duties. However, they must meet the following requirements:

a) Be equal to or higher than the minimum wage standard for unskilled employees performing simple tasks;

b) Be at least 7% higher than the minimum wage standard for skilled/trained employees performing their duties.

Regular working hours, overtime and vacation

Regular Working Hours

According to Vietnamese labor law, normal working hours should not exceed 8 hours per day or 48 hours per week. This can be extended by agreement between the employer and the employee, but normal working hours should not exceed 10 hours per day or 48 hours per week.

Overtime

Employers can request employees to work overtime, provided that the employer obtains the employee’s consent. Employers must ensure that overtime does not exceed 50% of the normal working hours per day (or a total of 12 hours when applicable to weekly working hours regulations) and does not exceed 30 hours per month or a total of 200 hours per year unless the government specifies in certain special circumstances that overtime cannot exceed 300 hours per year.

Employees working overtime are entitled to additional wages. The overtime pay on regular workdays should be at least 150% of their current wage unit. Weekend overtime pay should be at least 200% of their current wage unit, and overtime pay on public holidays and paid leave days should be at least 300% of their current wage unit.

Vacation

Employees who are 18 years or older and pregnant women who are seven months pregnant or have children under one year old are entitled to an extra hour of rest each day and are not allowed to work overtime.

Employees are entitled to at least one day of rest per week.

Employees with at least 12 months of service are entitled to a minimum of 12 days of paid annual leave per year, in addition to the 10 public holidays each year. Workers engaged in hazardous occupations or residing in adverse living conditions may be entitled to an additional two to four days of leave. Furthermore, employees typically receive an additional day of leave for every continuous five years of service.

Employees have sick leave entitlement, but employers do not provide sick pay. The Social Insurance Fund provides sickness allowances to employees and provides allowances to female employees caring for sick children. The maximum duration of sick leave per year is 30 days (in most industries and occupations), and the leave for caring for sick children is 15 days. The allowance, in lieu of wages, is typically 75% of the wage.

Social Security

Vietnam’s mandatory Social Insurance, Health Insurance, and Unemployment Insurance (SIHIUI) system covers sickness, maternity, work-related injuries, unemployment, retirement, and survivor benefits. Employers and Vietnamese employees must contribute monthly to the Social Insurance Fund for mandatory Social Insurance, Health Insurance, and Unemployment Insurance.

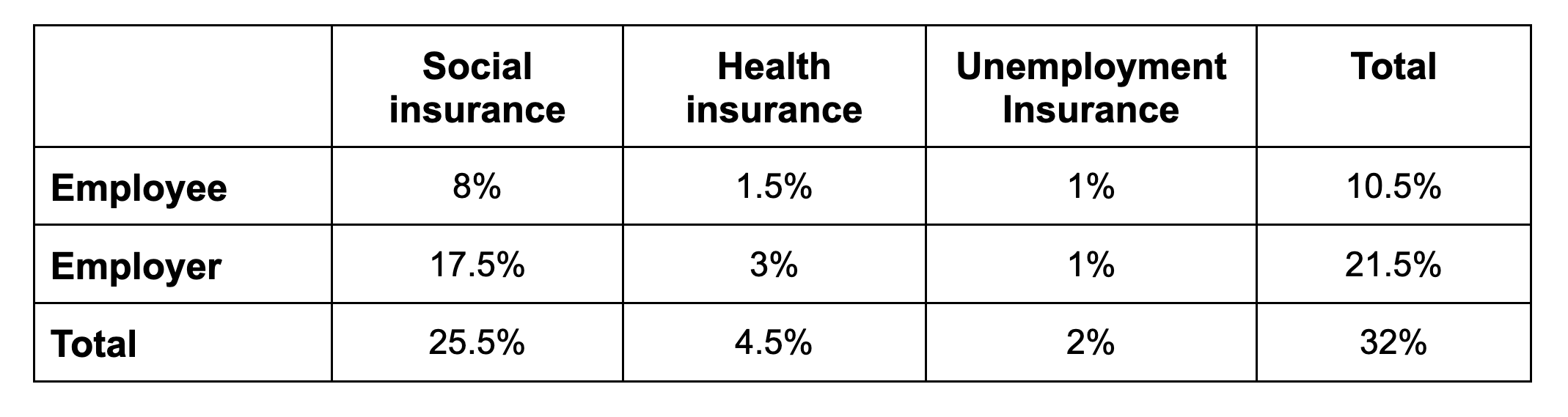

The mandatory contribution rates for employees and employers are as follows:

Since January 1, 2015, employees with labor contract terms of more than 3 months are required to mandatorily contribute to SIHIUI, regardless of the number of employees in the labor unit, in contrast to the situation before 2014.

By Decree No. 47/2016/ND-CP, effective May 1, 2016, the statutory wage rates for civil servants, public employees, officials, and workers were prescribed. According to this decree, the statutory wage rate increased to 1,210,000 Vietnamese Dong per month.

As a result of changes in this decree, the maximum wage bases used for calculating contributions to Social Insurance (SI), Health Insurance (HI), and Unemployment Insurance (UI) are as follows:

The wage base for calculating SI and HI contributions shall not exceed 20 times the regional minimum wage standard. This means that, starting from January 1, 2018, employees working in Ho Chi Minh City will have a wage base of 796,000 Vietnamese Dong per month (20 times the regional minimum wage standard of 3,980,000 Vietnamese Dong).

The wage base for calculating UI contributions shall not exceed 20 times the regional minimum wage standard. This means that, starting from January 1, 2017, employees working in Ho Chi Minh City will have a wage base of 750,000 Vietnamese Dong per month (20 times the regional minimum wage standard of 3,750,000 Vietnamese Dong).

Retirement benefits are provided under the mandatory Social Insurance system.

The retirement age for males under the Social Insurance scheme is the official retirement age, while for females, it is 55 years old.

A maximum deduction of 1,000,000 Vietnamese Dong per month is allowed for contributions to supplementary pension plans. Although supplementary pension plans are in their early stages, it is expected that more providers will introduce such plans. These plans will provide employees with better retirement support and savings options, diversify the sources of retirement income, and provide employers with a means to retain key employees.

Reference to our one-stop services for Taiwanese businesses | Link